Tax clinic

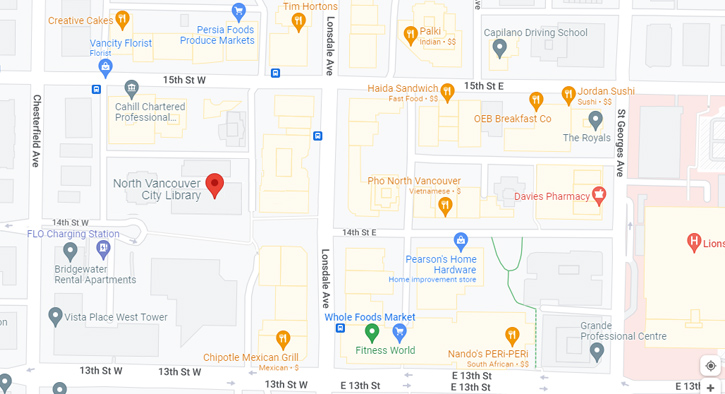

Get free help preparing your 2025 federal income tax return at City Library! You'll be helped by a volunteer, under the CRA's Community Volunteers Income Tax program.

The program runs from March 3 to April 30, 2026. Sessions are generally 30 – 60 minutes, and are in-person.

Request an appointment

Eligibility

You must be a North Shore resident, and not earn more than the limits specified below:

| Family size | Total income not to exceed |

|---|---|

| One person | $40,000 |

| Two people (e.g. a couple in a common-law marriage): | For a couple — $55,000 for the couple, and $5,000 for each dependent family member (e.g. the limit for a common-law couple with two children under 18 would be $65,000) |

| One person and one dependent (e.g. a single parent and child) | One person and one dependent (e.g. a single parent and child) — $45,000 and $5,000 for each dependent |

Exclusions

Because this is a volunteer-assisted program, services might be limited if your tax situation is complicated. We are unable to help complete tax returns for people who:

- Are self-employed or have employment expenses;

- Have business income and expenses (unless the income is in box 048 on a T4A slip and less than $1,000 with no related expenses);

- Have interest income of $2,000 or more;

- Have capital gains or losses;

- Are filing or have filed for bankruptcy;

- Are completing a tax return for a deceased person;

- Are completing tax returns for prior years.

Get ready for your appointment

Please bring the following to your appointment:

- Your SIN card

- All applicable tax information, e.g. T4, T5 or T5007 slips for 2025, medical receipts, tuition or school receipts (T2202), immigration papers and CERB info (if you received it)

- A copy of your 2024 tax return

- Government-issued photo ID

Don't live in North Vancouver? Find a tax clinic in your area. For all other enquiries please phone Canada Revenue Agency at 1-800-959-8281